When the fundamentals of microfinance are followed, great outcomes are achieved. This is true with Bandhan Bank which has been given universal banking license by the Central Bank of India in 2015. In just 15 years of establishment as an NGO, Bandhan which has been operating microfinance for the poor first transformed into a Non-Banking Financial Company and then into a full-fledged technologically adept bank serving its over 12 million customers.

For the purpose of exposing CEOs and Board Officials to the microfinance activities of Bandhan Bank, India, the Centre for Self-help Development (CSD) organized a Study Visit to Bandhan Bank from May 20 – 27, 2018. The 10 member team traveled to Assam and Meghalaya to observe the microfinance activities and operations firsthand. The team was led by the Director of CSD, Mr. Satish Shrestha and coordinated by Senior Officer Ms. Stephaniema Rana.

The team visited the field activities in Shillong, Meghalaya and Guwahati, Assam during which they were surprised to witness the discipline and commitment of both the members and staff during the group meetings. Bandhan has givencontinuity to its weekly group meetings and has maintained close contact with its members. The group members of Sharada Bandhan in Guwahati shared that Bandhan has contributed to their socio-economic up-liftment, increased income levels and improved quality of lives.

“The members of Bandhan are well disciplined despite being such a large group. Additionally, 90-100% members are loanees as compared to Nepal’s just 60% loanees per center. In Nepal we carry out credit appraisal just because it is a requirement. But in India, they undertake careful credit appraisal as they realize its role in reducing the chances of default,” said Mr. Nara Hari Neupane of Sahara Nepal.

As observed by Ms. Chandrakala Neupane of Mahila Upakar Manch, the members were making loan demands only as per theirrequirement. One microfinance member from Motinagar, Shillong said, “If we take many loans, we have to make equally more repayments. The weekly repayment system is to our benefit as we can pay smaller loan instalments each week. We are satisfied with the loan provided by Bandhan and do not have the need for additional loans.”

In Bandhan, loan amounts of upto INR. 1.5 lakhs is handled by the micro-banking branch while those of above INR 2 lakhs is handled by the banking branch. All financial transactions are clearly recorded at the group meetings, both by the field officer as well as by the members. A copy of the receipt from the POS (Point of Sale) machine is provided to he group as well for safekeeping.

Appreciating the systematic use of technology in Bandhan, Mr. Hari Niraula of Sahara Nepal SACCOS said, “In Nepal we went too far ahead with technology use without considering certain factors. Here, the POS machine used by the field officers is simple, efficient and effective.” Noting the efficiency of the field staff Mr. Bir Bahadur Adhikari of Shreejana Development Centre commented, “The work is completed within the day. I am impressed with the neat, simple and up-to date operation system.” During the interaction at the Doorstep Service Centre (DSC), Nepal’s equivalent of Branch Office, the staff shared howthey tackled loan defaulters. Contradictory to Nepalese MFIs, in Bandhan, no group pressure is exerted on the defaulter. The DSC Head has to make a compulsory household visit on the day of default itself. Personal householdvisit is made to ascertain the member’s situation and members are encouraged to pay only the amount that they can afford. Moreover, they are encouraged to continue attending group meetings so that the relation with Bandhan remains intact. In the case of default due to business failure, time is given for recovery before disbursing a fresh loan.

“I greatly appreciate Bandhan’s simple living, high thinking philosophy. There is cooperation and coordination at all levels and the staff are diligent workers,” said Mr. Ganesh Bdr. Chand of Udayadev MP Coop. Ltd. Each DSC has a poster exhibiting Bandhan’s values of CREATE - Cost effective and simple, Respect for all, Exemplarygovernance, Accountability, professionalism and discipline, Transparency and integrity, and Effective team work and commitment which is followed by all levels of staff. The team also discussed with Mr. Kangkan Mazumdar, the Regional Head who voiced the values of Bandhan. He said, “The members are the owners of Bandhan and we are their employees.” As the Regional Head he oversees six states, 7 clusters, 348 DSCs, around 2663 staff and 12 lakh clients with a loan portfolio of INR. 5,000 crores.

Impressed with the close monitoring and supervision by the Area, Cluster and Regional levels Mr. Ek Raj Giri and Mr.Hem Raj Giri of Sahara Nepal said, “We will also try to inculcate the same system in our organization. We appreciate the helpline numbers at the DSC for the members to contact the office in case of any emergency.”

Mr. Batuk Shrestha of Shrijana Community Development Center said, “I have noticed that Bandhan has covered almost all the target groups in their area. The staff are dedicated and committed and there was no evidence of hierarchy among them. There is no micro-loan above INR. 1.50 lakhs, whereas in Nepal the Central Bank itself allows collateral free loans up to NRs. 3 lakhs.”

The visit to the Training Learning Centre (TLC) in Rangia, Guwahati was an eye opener for the participants. There the team realized the need for regular training and human resource investment. Bandhan has eight TLCs pan India and provides a minimum of one training per year per staff up to DSC level. Training programs are conducted throughout the year, with the resource persons comprising of faculty members and staff from Bandhan School of Development Management (BSDM), the Head Office and Regional Office.

The Doorstep Banking Officers (DBOs) are recruited under de-centralized free competition. A C.V. box is maintained at all DSCs where aspiring candidates can drop-in their C.V. which is later forwarded to the Head Office. A field verification is conducted by the Area Head to verify the candidate’s background and character. Once the candidate passes his/her interview they are sent to the TLC for an eight-day orientation course, which includes field visits as well. A non-refundable training fee is also charged from the candidates. The candidates are exposed to their expected duties and responsibilities and only after the completion of the course is their recruitment finalized. As a result of such exposure, the drop-out rate of staff is minimum. “Motivation is the key factor and in Bandhan there is motivation and team work from the top to bottom level. A large population, easy mobility and the conducive policy of the Government is also favorable towards Bandhan,” said Mr.Jiban Acharya of Dhaulagiri Community Resource Service Center. Summing up the visit, Mr. Satish Shrestha said, “The Nepalese MFIs have drifted from the original mission of microfinance. In Bandhan they follow the same values from top to bottom level keeping the fundamentals intact. They have used technology to their best interest and the staff are mature and satisfied. The job description of staff is simple and clear and field officers are recruited between 20 – 30 years of age, when they are already mature.” “The study visit was very well planned where one observation was tied up with another visit. We have learnt from Bandhan’s experience and hope to inculcate a few changes in our organization,” said Mr. Gyanu Nath Mainali of Sahara Nepal.

As the CEOs and BoDs of prominent MFIs of Nepal participated in the study visit, it is hoped that the visit will result in effective implementation of programs and action plans which will follow the principles of microfinance.

Under the initiation of the principle Microfinance Institutions (MFIs) and co-ordination of the Centre for Self-help development (CSD) a first ever, national level 'National Microfinance more...

“Entrepreneurship Development, the Way towards Poverty Alleviation”

For the first time in the history of microfinance in Nepal, and unheard of in the global more...

In view of the stir created by the new Monetary Policy of the Nepal Rastra Bank (NRB) among the Microfinance Institutions (MFIs), the Centre for Self-help Development (CSD) felt the need more...

On Shrawan 28, 2073 (August 12, 2016) promoters, individuals and institution members, former Board Directors, Microfinance Institution leaders and friends came together at the Hotel Yellow more...

The Centre organized a two-day seminar for the Board Officials of the prominent microfinance cooperatives of Nepal on the request of various Cooperative Institutional Members of the Centre more...

‘Learning gives creativity, Creativity leads to thinking, Thinking provides knowledge, Knowledge makes you great’ – APJ Abdul Kalam

Kick starting the year 2017, the Centre for more...

On the morning of February 9, 2017 the Centre for Self-help Development (CSD) in joint collaboration with the Grameen Trust (GT), Bangladesh initiated a two-day program on the Grameen more...

A nine member team comprising Board of Directors from 2 FINGOs from Nepal, namely- Dhaulagiri Community Development Centre (DCRDC, Baglung) and Sreejana Community Development Centre (SCDC, more...

It is with deep sorrow and regret we bid farewell to Mr. Nanda Ram Baidya who passed away on August 15, 2017. In memory of the affable and ever encouraging figure the Centre for Self-help more...

On the morning of March 9, 2017 the Centre for Self-help Development organized an interaction program on an experience sharing session with Mr. Chandra Shekhar Ghosh, Founder and Managing more...

The Centre for Self- help Development (CSD) organized a training program titled "Advanced Training of Trainers" held in Kathmandu. The five day training program was held from September more...

Over the years, the Microfinance Institutions (MFIs) in Nepal have been proactive in providing financial as well as social services to vitalize the financially excluded households in more...

The pioneer microfinance institution of Nepal, the Centre for Self-help Development (CSD) convened its 26th Annual General Meeting on October 8, 2017 amidst its members, both individual more...

- An experience of Nepalese Delegation

A delegation of Nepalese microfinance officials visited the Philippines from January 15-19, 2018 on the invitation of the Microfinance Council of more...

CSD has appointed Mr. Bechan Giri as the new Executive Chief effective from December 26, 2017. Mr. Giri’s appointment comes with the resignation of former Executive Chief of CSD, Mr. more...

To enable microfinance institutions to apply sound accounting principles to ensure high quality of financial analysis the Centre for Self-help Development conducted a three-day training more...

- A Symposium of Board Officials

In over 25 years of service to the financially excluded segments of the society, the microfinance sector has thrived and expanded its outreach to the more...

Keeping in view the strong and rapid growth pattern in the microfinance sector and the competitive lending environment, CSD organized a three day training program titled "Training on Risk more...

“Learn as if you were to live forever” – Mahatma Gandhi

Realizing the immense potential to learn from each other through experience sharing and field visits within the country itself, more...

When the fundamentals of microfinance are followed, great outcomes are achieved. This is true with Bandhan Bank which has been given universal banking license by the Central Bank of India more...

Bangladesh is often hailed as the ‘Mecca of Microfinance’ across the world. The concept of micro-credit and the credit worthiness of the poor was first discussed by Prof. Muhummad Yunus in more...

One of the pioneering institutions to provide microfinance services in Nepal the first licensed NGO, the Centre for Self-help Development (CSD) celebrated its 27th Anniversary at a more...

The Centre for Self-help Development (CSD) one of the pioneers of microfinance in Nepal convened its 27th Annual General Meeting on October 26, 2018 in Kathmandu. The meeting was attended more...

A training to develop “Managerial Skills” of Branch Managers of MFIs was organized by CSD in Kathmandu from January 7-9, 2019 (Poush 23-25, 2075) to enhance managerial skill level of the more...

A one-day dialogue on microfinance was organized by Unique Nepal Laghubitta Bittiya Sanstha Ltd. on February 9, 2019 (Magh 26, 2075) in Hotel Atithi, Kohalpur. A total of 42 participants, more...

On the invitation of the Grameen Trust, Bangladesh a delegation of nine senior Nepalese microfinance practitioners led by Mr. Shankar Man Shrestha, Chairman of CSD visited Bangladesh from more...

The team observed that all the members are borrowers and strictly followed the basic fundamental of microfinance like conducting weekly meeting, implementing credit plus activities, more...

The microfinance sector in Nepal has been mushrooming at an alarming rate in the past five years. Newer microfinance institutions (MFIs) have sprung up, who do not necessarily follow the more...

“If we can turn unemployment into entrepreneurship, the amount of human creativity, talent and productivity we will unleash is almost beyond measuring” – Prof. Muhammad Yunus

Taking more...

The Centre for Self-help development (CSD) organized a conference on Human Resource Management for microfinance Institutions from Ashadh 10-11, 2076 in Dhulikhel, Kavre. The conference was more...

From June 28 – 29, 2019 over 1,500 delegates from across the world came together to celebrate and take forward social business on a global scale at the 9th Social Business Day (SBD) held more...

Microfinance has existed as one of the major contributors to poverty alleviation serving over 4 million members in the seventy seven districts of Nepal. But in recent times the sector has more...

One of the initiators of microfinance services and the first licensed microfinance NGO in Nepal, the Centre for Self-help Development (CSD) celebrated its 28th Anniversary at a function more...

The Centre for Self-help Development (CSD), which is one of the pioneer institutions to launch microfinance in Nepal, convened its 28th Annual General Meeting on December 13, 2019. The more...

The Centre for Self-help Development (CSD), which is one of the pioneer institutions to launch microfinance in Nepal, organized a Symposium on Fraud Control and Management on December 14, more...

CSD Chairman Mr. Shankar Man Shrestha felicitated on January 21, 2020 by the Agricultural Development Bank on the occasion of its 53rd Anniversary for his valuable contribution to the more...

With the rapid expansion of microfinance sector in past few years in Nepal, the sector has been facing numerous problems and challenges due to deviations from the true essence and more...

The Centre for Self-help Development (CSD) has entered in 30th year. It was established on August 13, 1991 (Shrawan 28, 2048) with the vision of alleviating poverty by raising the living more...

The Chairman of the Center for Self-help Development (CSD), Mr. Shankar Man Shrestha in a webinar organized by CSD on Bhadra 2, 2077 (August 18, 2020) urged the officials of Kisan more...

A webinar was organized by the Centre for Self-help Development on March 2, 2021 to acquaint development practitioners with basic concept of eco-village model, its approach and possible more...

CSD has expanded its team members to better coordinate and cope with the new activities as well strengthen the standard of its service delivery. It is very fortunate to have additional 5 more...

The extent of the damage that the novel coronavirus pandemic is causing is mind-boggling. However, the situation also offers us an unparalleled opportunity.We have experience in managing more...

The Sree Ram Higher Secondary School, Koshidekha, Panchkhal Municipality ward no 13, Kavrepalanchok district launched a student entrepreneurship development program in cooperation with the more...

The Centre for Self-help Development (CSD) has entered in 30th year. It was established on August 13, 1991 (Shrawan 28, 2048) with the vision of alleviating poverty by raising the living more...

CSD organized a virtual interaction with its member cooperative organizations on August2, 2020 to discuss on problems and challenges and opportunities arisen from the corona virus pandemic more...

Chairman of the Centre for Self-help Development Mr. Shankar Man Shrestha has suggested the microfinance staff to face the Corona epidemic and lockdown crisis while maintaining the essence more...

The Chairman of the Center for Self-help Development (CSD), Mr. Shankar Man Shrestha in a webinar organized by CSD on Bhadra2, 2077 (August 18, 2020) urged the officials of Kisan more...

The Center for Self- help Development (CSD) organized a 3 day PPI Training of Trainers (TOT) to 23 senior officials and branch managers of microfinance institutions in Biratnagar in more...

The Centre for Self-help Development (CSD) organized a study/exposure visit to Bangladesh from March 19-26, 2023. The visit team consisted of nine Board Members and one staff member of more...

The Chairman of the Centre for Self-help Development (CSD) Mr. Shankar Man Shrestha has suggested the microfinance practitioners to study and review the problems and opportunities faced more...

The Centre for Self-help Development (CSD) has instituted Micro-Entrepreneurship Award for three outstanding micro-entrepreneurs from among the women members MFIs. The award carries Rs. more...

Centre for Self-help Development (CSD) organized two day of Virtual training on "Promotion and Development of Micro-entrepreneurship among microfinance Members" on November 24-25, 2020 more...

During the lockdown period, the Centre for Self-help Development (CSD) conducted online interactions with CEOs and Department Heads of its member organizations. A total of six online more...

The Centre for Self-help Development (CSD) convened its 29th Annual General Meeting (AGM) on November 27, 2020 (Marg 12, 2077). The AGM was attended by 9 individual and 38 institutional more...

CSD Chairman Mr. Shankar Man Shrestha felicitated on January 20, 2020 by SLBBL on the occasion of its 19th Anniversary for his valuable contribution to the creation and development of the more...

CSD organized two day virtual training on "Identification and Development of Micro-Entrepreneur Members" from Magh18-19,2077, (Jan31-Feb1, 2021) where17 branch managers and senior field more...

The Centre for Self-help Development (CSD) has provided a desktop computer with necessary accessories to Kunchipwakal Secondary School under the Tarkeshwor Municipality-1, Kathmandu in its more...

The Centre for Self- help Development (CSD) organized a virtual webinar on “Sharing Grameen Bank Experience on Managing Impact of COVID 19 Pandemic and Post COVID Programs” on 20th January more...

The Centre for Self-help Development (CSD) awarded three best Microfinance Entrepreneurs members with the title of “Best Micro-entrepreneur Award-2076.” Honorable Minister for Land more...

The Chairman of the Centre for Self-help Development (CSD) Mr. Shankar Man Shrestha handed over a cheque of Rs. 2 lakh to the Samata Education Trust on March 9, 2021 as a token of support more...

On March 05, 2021 (Falgun 21, 2077) the Centre for Self-help Development (CSD) successfully completed a review webinar on the action plan developed by participating branch managers of more...

The Center for Self-help Development (CSD) conducted a two–day training on “Leadership Development and Stress Management” in microfinance on March 18-19, 2021 (Chaitra 05-06, 2077). The more...

With the main objective of knowing the knowledge and skill gained during the training "Gear up yourself" which was held on January 18-19, 2021(Magh 5-6, 2077) is practically applicable to more...

The Centre for Self-help Development (CSD) conducted a two-day virtual training on "Identification and Development of Micro–entrepreneur Members in Microfinance on March 14-15, more...

CSD on Chaitra 02, 2077 (March 15, 2021) hosted yet another webinar as part of Experience Sharing forum for microfinance institutions officials. This webinar talk program was participated more...

A webinar was organized by the Centre for Self-help Development (CSD) on March 30, 2021 to apprise microfinance practitioners and other stakeholders on problems and effects caused by more...

The Centre for Self-help Development (CSD) organized a webinar talk on April 16, 2021 to sensitize microfinance practitioners and other stakeholders on policy level as well as practical more...

A webinar talk on Vitality and Vulnerability of Wholesale Lending Organizations in the Present Niche Market of Microfinance was organized by the Centre for Self-help Development (CSD) on more...

A webinar on Neutralizing Corona Impact on Microfinance was organized by the Centre for Self-help Development (CSD) on May 13, 2021. The second wave of COVID-19 in Nepal is more lethal and more...

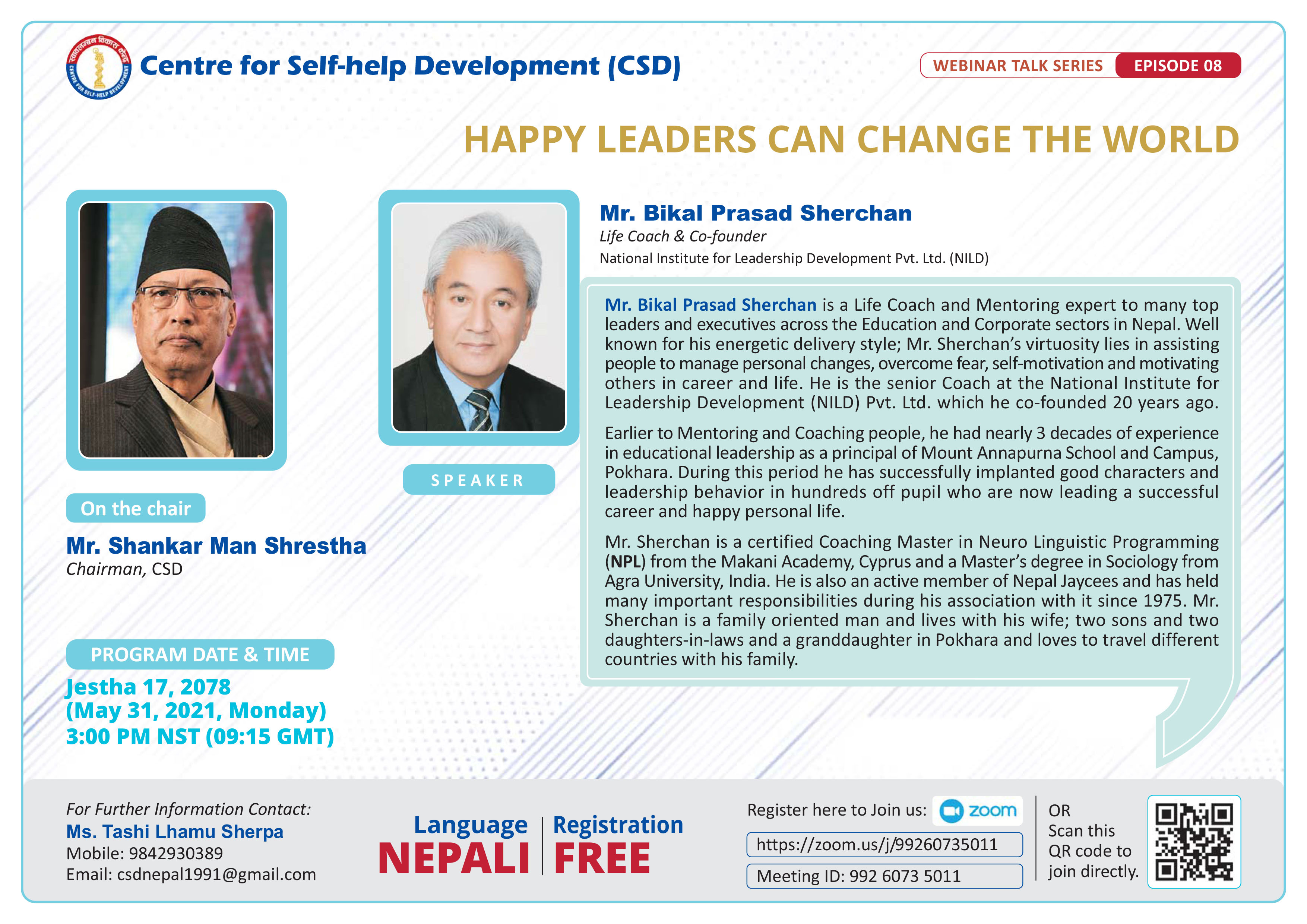

A webinar talk program on “Happy Leaders Can Change the World” was organized by the Centre for Self-help Development (CSD) on May 31, 2021 with the aim to to discuss on the concept of more...

A webinar talk (Series No 9) on Secrets of Success in Microfinance was organized by the Centre for Self-help Development (CSD) on June 16, 2021. The webinar focused on philosophy and more...

The leaders in the field of microfinance are of the view that a time has come for all microfinance institutions to digitize microfinance services to provide easy access to the deprived and more...

Microfinance has completed a three-decade long journey in Nepal. With continuous campaigns, it had brought awareness among the poor women in rural Nepal. Microfinance practitioners have more...

Four institutional members of the Centre for Self-help Development (CSD) have been accredited by the international “Smart Campaign, Client Protection Certification.” The awardees are the more...

The Training of Trainers (ToT) aiming to spread covid-19 education among the community was organized jointly by the Centre for Self-help Development (CSD) and RMDC Laghubitta Bittiya more...

Expressing concern over the growing discrepancies and deviations in microfinance, experts have warned microfinance practitioners and stakeholders to be vigilant in time. In the webinar more...

The Centre for Self-help Development (CSD) established in 1991 with the objectives of creating poverty free self-help society through awareness rising and of the masses and mobilization of more...

The Centre for Self-help Development (CSD) has organized two days long training on Participatory Rural Appraisal (PRA) on August 20-21, 2021 for the 16 high officials of the Centre for more...

The Centre for Self-help Development (CSD) had initiated a new approach to the follow-up of the training conducted by it with a view to ensure that the skills learned by the training are more...

A webinar talk series (Episode 14) on “Microfinance Policies, Practices and Problems in Sri Lanka” was organized by the Centre for Self-help Development (CSD) on September 6, 2021, with more...

The Centre for Self-help Development (CSD) held a six-month progress review of its second training on "Identification and Development of Micro-entrepreneurs" on September 12, 2021, which more...

A virtual Master Training of Trainers (ToT) to educate communities on COVID-19 via ZOOM was jointly organized by the Centre for Self-help Development (CSD) and RMDC Laghubitta Bittiya more...

Experts have argued that the lack of good governance in Microfinance Institutions (MFIs) has led to deviations from its main mission of serving the lower strata of the population and more...

Microfinance institutions have a strong belief that their grass-root level financial inclusion program has bestowed the fight against global challenges such as poverty, unemployment, and more...

A tripartite agreement on "Self-help Eco-village Development" was signed between the Centre for Self-help Development (CSD), the Mahila Sahayogi Bachat Tatha Rin Sahakari Sanstha Ltd. more...

The Centre for Self-help Development (CSD) convened its 30th Annual General Meeting (AGM) on December 2, 2021 (Marg 16, 2078). The AGM was attended by 6 individual and 26 institutional more...

On 13th of December 2021, the Centre for Self-help Development (CSD) put forward its 17th episode of webinar entitling "Human Resource Development and Management in Microfinance more...

CSD organized a two day "Mindful Leadership Development" Program for the Chairperson, CEOs and DCEOs of Microfinance Institutions and Cooperatives operating microfinance program from more...

The Centre for Self-help Development (CSD) organized a webinar talk on “Experience of Grameen Koota on Poverty Reduction and Employment Creation in India” to acquaint microfinance and more...

The Centre for Self-help Development (CSD) has organized a two-day leadership development training to increase women participation in management decision level of the Microfinance with more...

Kathmandu. Three women entrepreneur members who became successful entrepreneurs by taking loans from different microfinance institutions have been awarded the Best Micro-Entrepreneur more...

A webinar talk (episode no. 19) on “Entrepreneurship Development among Students-An Experience of Janajyoti Higher Secondary School, A Rural School of Surkhet District” was organized by the more...

The Sree Ram Higher Secondary School, Koshidekha, Panchkhal Municipality ward no 13, Kavrepalanchok district launched a student entrepreneurship development program in cooperation with the more...

The Centre for Self-help Development (CSD) convened 12th Social Business Day 2022, Country Forum of Nepal on June 29, 2022 based on the theme, “Building a New Civilization-Before the more...

The Centre for Self-help Development (CSD) which is the pioneer NGO in microfinance sector celebrated its 31st anniversary on 13th August, 2022 (Shrawan 28, 2079). During the occasion, more...

The Centre for Self-help Development (CSD) organized three Exposure Visits of microfinance practitioners of different Microfinance Institutions (MFIs) and Microfinance Cooperative more...

CSD organized a week long exposure/study visit of Nepali MFIs to Socialist Republic of Vietnam from August 13 to 20, 2022 to learn the microfinance policies, programs, approaches and more...

The Centre for Self-help Development (CSD) in partnership with the University of New South Wales (UNSW), Sydney, Australia, organized a seminar on the topic "Emerging Challenges and more...

Branch managers and employees of microfinance institutions were encouraged to mobilize more resources in their hands for reliability of financial resources supporting for lending the more...

A review program was conducted on February 27, 2023 with the participation of the heads of MFIs to discuss the latest status and progress on the implementation of 11-point declaration of more...

A five-day specially tailored program on entrepreneurship development was organized by Centre for Self-help Development (CSD) for the Branch Managers of Swabalamban Laghubitta Bittiya more...

Convoked 31st General Assembly of CSD: Emphasized on Promotion of Social Entrepreneurship and Expansion of Microfinance Reach to Hard-Core Poor

The 31st General Assembly of the Centre more...

The 31st General Assembly of CSD has elected a seven-member Board of Directors for the next two years. In this committee, the elected members are: the founding members of CSD, Mr Shankar more...

The Center for Self- help Development (CSD) organized a 3 day PPI Training of Trainers (TOT) to 23 senior officials and branch managers of microfinance institutions in Biratnagar in more...

Experts are of the view that the 8-point directive of the Nepal Rastra Bank (NRB) will help to improve the quality as well as the strength of the microfinance sector in long term and bring more...

The Centre for Self-help Development organized an online orientation program on “Progress out of Poverty (PPI) Index” on November 8, 2022. The objective of the program was to orient more...

In the last two decades microfinance in Nepal has taken a big leap forward in terms of the number of institutions providing loans, volume of loan transactions and the number of client more...

The First Provincial Microfinance Members' Summit of the Koshi Province was concluded with the vow to make microfinance services civilized, dignified and effective and also decided to more...

The Centre for Self-help Development (CSD) organized a 4 day field based Self-help Eco-village Development workshop from January 29 to February 1, 2023 at Dhulikhel Lodge Resort, more...

The Centre for Self-help Development (CSD) has initiated an entrepreneurship development program with the aim of developing about 5,000 entrepreneur women among microfinance members within more...

The Centre for Self-help Development (CSD) organized a study/exposure visit to Bangladesh from March 19-26, 2023. The visit team consisted of nine Board Members and one staff member of more...

On the occasion of 32nd Anniversary of the Centre for Self-help Development held on August 13, 2023, MFIs and microfinance practitioners who have made outstanding contribution in providing more...

Shankar Man Shrestha Microfinance Award is provided to any individual or institution that adheres to the norms, principles and values of microfinance and acts as a role model in carrying more...

The Centre for Self-help Development (CSD) awarded Micro-entrepreneurship Development Award and Best Entrepreneurs award for the year 2023 2023 on the occasion of its 32nd Anniversary more...

In a proactive effort to fortify the microfinance sector, the Centre for Self-help Development (CSD) orchestrated a successful three-day training program titled "Internal Audit & Control" more...

On the occasion of 4th Nation Microfinance Member Summit 38 MFIs members, staffs, centre chief, 3 Zero Club were recognized & appreciated. Where 11 Centre Chief, 1 organization, 10 Staff, more...

The 32nd Annual General Meeting of the Centre for Self-help Development (CSD) was held on Sunday, December 10, 2023. The meeting decided to urge MFIs and MFCs to work to improve the more...

The Centre for Self-help Development (CSD) which is the pioneer NGO in microfinance sector in Nepal celebrated its 32nd anniversary on 13th August, 2023 (Shrawan 28, 2080).

With the theme “Prudent Microfinance, Prosperous Members”, the 4th National Microfinance Members' Summit, Nepal concluded with the issuance of a comprehensive 12-point declaration, more...

(1).jpg)

.jpg)